Banking and Financial Services

To keep pace with challenging times and compete in an ever-changing financial market, Financial Institutions (FIs) need to be able to create products and services to meet constantly changing customer needs, shifting regulatory requirements and the demands of increasing cybersecurity risks. The Banking industry is being built on full digitalisation with the adoption of new technologies like automation and cloud at the heart of that change, but limitations of legacy IT systems continue to hinder many financial institutions from enhancing their customer experience. With the customer experience as the main focus, banks need to modernise their core front and back-end systems, applications and business processes to operate in an innovative and agile way..

How Can VIP Apps Consulting Help You?

VIP Apps Consulting brings together the expertise, capabilities, and a technology alliance ecosystem to modernise core FI and banking systems and optimise business processes that deliver value in their operations and put the customer first.

Business process optimisation is a core goal for FIs looking to boost operational performance. We look for process overlaps and inefficiencies, review the permission and role matrices across your teams and systems, and develop recommendations for building more efficient and controlled processes throughout the organisation. Combined with the capabilities offered by our technology alliance partners, we are able to reduce or completely remove manual touch, streamline decision-making processes through automated data analysis, and help our clients get closer to the elusive paperless office.

Over the last few years, FIs have faced significant challenges, while at the same time, opportunities have emerged that have allowed many institutions to embrace innovative development, like open banking. Open banking uses application programming interfaces (APIs) to make certain customer data available, should the customer permit it, to third-party financial service providers. Through these APIs, external parties can transact directly with a financial institution’s core systems, providing the chance to create value offerings through data and the development of innovative products and services. Open banking requires a robust, agile, and scalable IT architecture to enable API integrations with multiple entities.

Our technology consultants can help you gauge internal capabilities and conduct a gap analysis to identify areas requiring capacity building and develop a scalable, agile infrastructure to offer greater modularity and easier configuration. Our business process experts optimise processes to integrate new workflows so that our clients can operate effectively in open banking environments. Together they identify internal processes and user journeys where API-enabled products and services can add greater value and unlock the banking value chain. Our approach enables access to data for better decision-making to deliver a seamless digital customer experience.

We understand how to plan, prepare and execute business and digital transformation projects in a manner that contains and mitigates risk, minimises or eliminates downtime and ensures minimal business interruption. We work with our clients to design the business process, build a compliance framework, support a system selection, and execute the implementation through to booking the first contract.

Unlike siloed services that other firms provide, our technology consulting services integrate a combination of accelerators, proprietary methodologies, and access to strategic alliances and platform ecosystems to modernise core business applications. Our services offer reduced dependency on legacy systems through simplification, and shift IT spend from maintenance to innovation and business agility, creating an adaptive enterprise. We help organisations create an applications landscape in the context of business function and business priorities, resulting in an organisation that’s ready for whatever the new normal brings.

The first step in your modernisation journey is running a system assessment to understand your applications environment and develop the business case. Our system assessment provides the organisation with valuable insight, reducing risks and costs by highlighting potential challenges and identifying areas of improvements.

Applications Modernisation

Often legacy systems are unable to deliver the demands of the market in a digital age and can be difficult to change and to realign to the new strategy. Business leaders need to plan the modernisation of their applications portfolios strategically. The benefits of modernising your legacy systems are clear:

- Efficiency

- Agility

- Scalability

- Gain insights from your data

- Solve security concerns

Our experts take a holistic approach to the modernisation of your business applications. Our strategic approach to application modernisation goes beyond a mere update to your legacy systems, looking into your technology, system architecture, organisation structure, and your business processes in place.

Where automation potential exists, we can help you identify the right combination of process and automation solutions to maximise value and deliver efficiency in accelerated timescales. We help you develop technology evaluation and selection criteria and identify business requirements for existing systems.

Enterprise Architecture Services

Our Enterprise Architecture Services help your organisation harmonise, consolidate and simplify your current and future application landscape. Define a roadmap to help increase interoperability, extend application lifecycles, gain efficiencies and reduce costs.

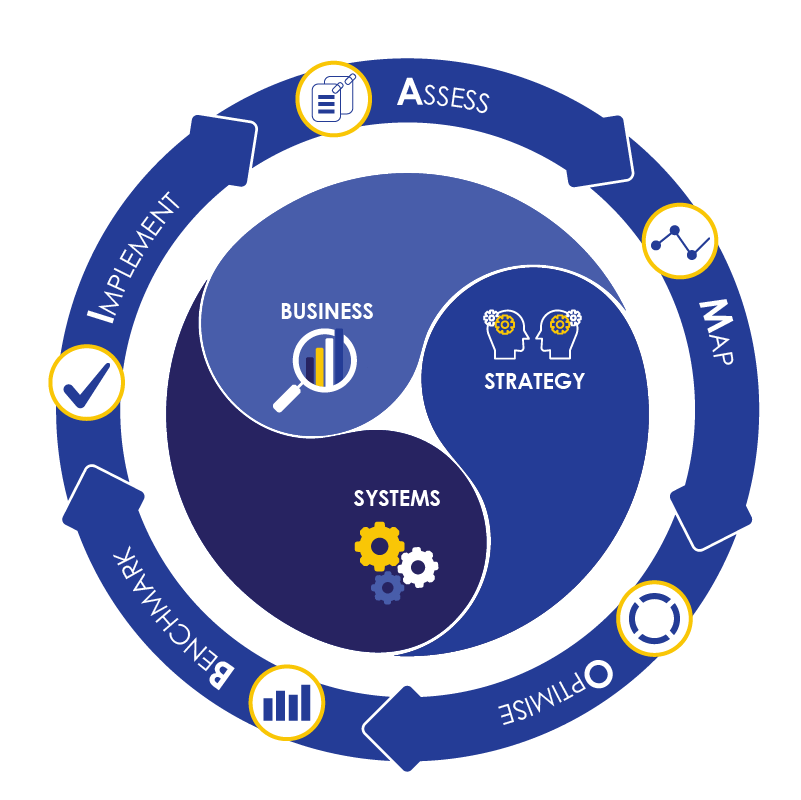

Our AMOBI methodology is the perfect companion in your journey to modernising your applications. The AMOBI way provides a unique collaborative approach between the business organisation, the systems that support it and the project organisation. AMOBI helps organisations find innovative ways to improve and optimise your existing systems and processes and realise additional value from your investment.

Data is increasingly important as organisations automate more business processes to become a digital-first organisation. Our experts work with your organisation to develop a data migration strategy that can accelerate your digital journey and deliver business transformation based on industry experience. We evaluate your existing data and measure its quality, determine whether your data meets the new application requirements, and make the necessary adjustments alongside your business processes in the new environment to assess the impact across all areas in your organisation.

Contact

Do you want to learn more about how we can help you?