With only months lefts before the new lease accounting standards ASC 842 and IFRS 16 become effective, many companies have not taken the steps needed to meet the deadline. In previous posts, we went through lists of questions to help CFOs assess in which stage of the transition plan the organisation is, transition guides and how to navigate the implementation challenges with our AMOBI methodology that provides the holistic approach required for this project. As the deadline for adoption draws closer, in this new post, we will discuss the key areas and steps you need to focus on now.

FASB Latest News

Last 30th July, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU). This attempts to ease the implementation of the ASC 842 new lease standard. The improvements looked to address areas identified as sources of unnecessary cost or complexity in the lease standard. The ASU simplifies transition requirements and, for lessors, provides a practical expedient for the separation of non-lease components from lease components.

The ASU provides:

• An option to apply the transition provisions of the new standard at its adoption date instead of at the earliest comparative period presented in its financial statements, and

• A practical expedient that permits lessors to not separate non-lease components from the associated lease component if certain conditions are met.

To access the FASB news releases, please follow this link.

Lessons Learnt from Early Adopters

For many companies, to bring virtually all leases onto the balance sheet requires new investments in IT and extensive work in abstracting leasing data. Early adopters have realised that the impact on systems and processes is greater than expected. Organisations are facing enormous challenges to determine the embedded leases as they review all service contracts. The time needed to identify, extract, analyse and input leases in the systems is taking longer than expected. As new data arise, the organisation find that their current systems do not support the unique needs, and requirements for customisation or new solutions increases. A holistic approach to the implementation has proved to be pivotal. Companies that run a complete assessment before moving into an implementation phase avoid risks of inefficiencies. A holistic approach in the adoption, one that involved all the stakeholders permits that the organisation to understand the complexity of the project, the effort and resources required, and the result of the assessment will be more realistic, enhanced with the input and expertise across the organisation and helps avoid surprises and minimise costs.

Key Steps in the Final Sprint

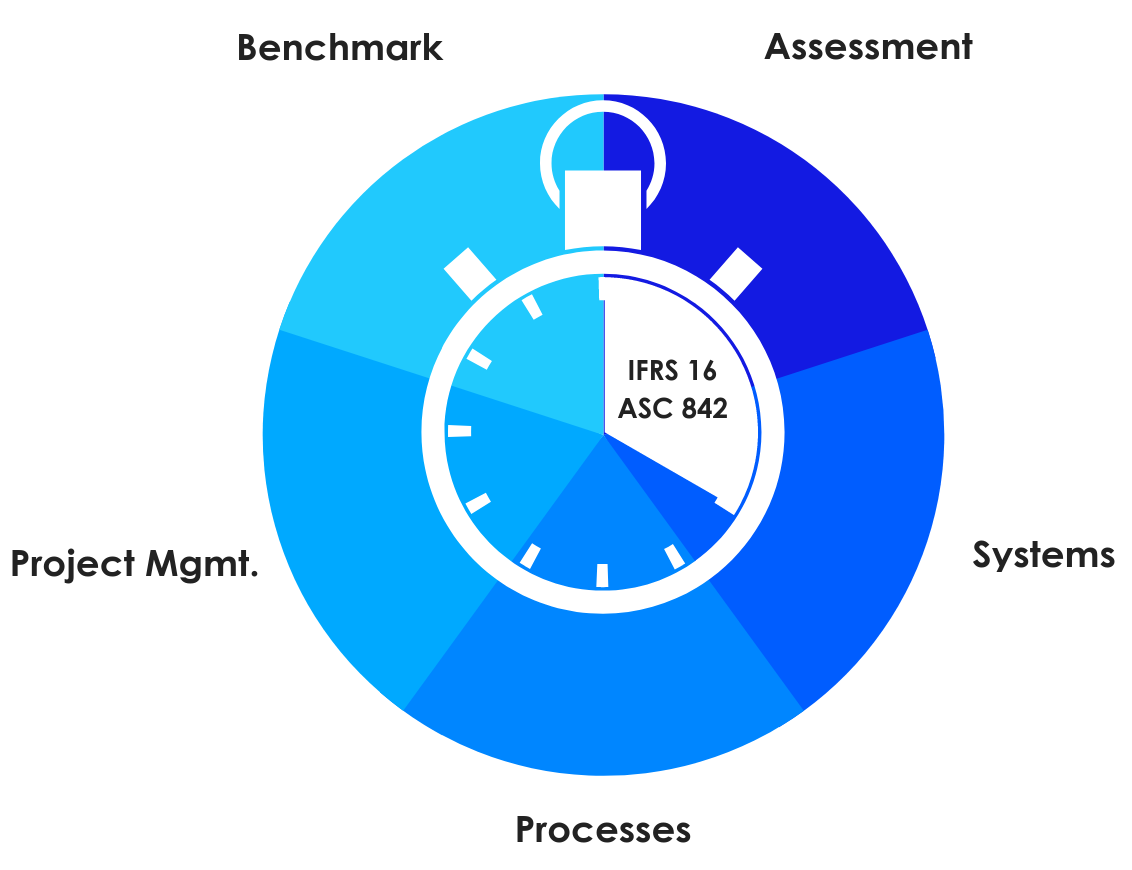

The new lease accounting standards will increase transparency, but lessons learnt from early adopters highlight the enormity of undertaking this implementation. As compliance date approaches, here are the key areas CFOs and their teams need to focus on now to minimise disruption and assure a successful adoption.

Assessment: complete your impact assessment and document a detailed plan, with a clear problem and goal statement to understand the impacts IFRS16 / ASC 842 will have on your business. A financial and operational impact report that also includes a high-level solution plan and business requirements, will help the CFOs understand where added costs might come from, risks and identify issues to address.

Systems: the new lease accounting standard requires organisations to collect data scattered across multiple locations and technologies. In many companies, systems and the accounting solutions in place do not support customisation to input new lease data and perform the required lease accounting and reporting. New IT System integrations, data migrations, testing, validations and the creation of new reporting, will need implementation times that exceed the time left to the compliance deadline. When choosing a partner for your lease accounting initiatives, proceed with caution. Different providers have different capabilities, ensure you chose a provider with a full range of services for a comprehensive lease accounting transition program. Oracle E-Business Suite Property Manager & Equipment Lease Functionality provides support for IFRS16 and ASC842 accounting standards with new functional and technical capabilities, and Oracle Financial Consolidation and Close Cloud provides an end -to- end solution that can be easily integrated with any Oracle and non-Oracle source application.

As a last resort, many will consider an interim solution and manual work-arounds for parallel tracking.

Business Processes: Adjust and establish new business processes, ready for the new standard and the systems. Our AMOBI methodology presents the optimal solution to define a new and optimised process map that will represent the future state including the system design and selection, where more processes are automated leveraging new system capabilities.

Project Management: make sure at this point, all key stakeholders, C-level executives and auditors are involved in the process. Communicate the financial impact and the complexity of the adoption, ensuring adequate resources and budget. Some companies have enough internal resources to run the adoption, but the project might require third-party assistance in the abstraction and data validation, the implementation of the new technology solution or the optimisation of business processes.

Benchmark: validate the extracted data from the lease contracts and test against future state workflow models with real business scenarios, identify gaps and running parallel tests to monitor financial statement impacts. Complete the financial validation of judgements and calculations. This will help you to determine further steps quickly in the final months of the implementation process.

How can VIP Apps Consulting help?

Our experience in the leasing and financial services industry and unique AMOBI methodology has positioned us to help your organisation address issues from the accounting interpretation, business process design and optimisation to systems changes and new implementation providing the change management support to address the new lease accounting adoption challenges.

If you have not yet begun, now is the time to contact us and jump-start your IFRS 16 and ASC 842 implementation journey.