The new lease accounting standards IFRS 16 and ASC 842 come into effect on January 2019, and as we are nearly halfway through 2018, organisations are running short on time to comply with the new guidance. In this post we will review some critical project considerations, so you can jump-start your implementation journey and finish it on time.

The new standard does not affect all organisations in the same way, but companies should be aware that implementation can be more complex and costly than expected. Under the new lease standard, the definition of the lease requires significant judgement. The new guidance requires that lessees apply a right of use and while some companies only have a limited number of leasing arrangements, others have a large number of off-balance sheet arrangements that will now need to find their way onto the balance sheet as lease liabilities and corresponding right-of-use assets.  While the burden of the lease changes would seem only to hit the accounting departments, the new standard goes beyond a finance function exercise, and the implementation requires a holistic approach. There will be an impact across the organisation, and efforts should also heavily involve the operations, IT, treasury, tax, facilities and procurement groups. Today many companies do not have systems in place to effectively manage lease agreements under the new standard and are likely to need to review internal controls and related business process for capturing and accounting for lease agreements. Initial activities should concentrate on understanding the new standard and how it relates to the complexity of your company to determine the requirements and impact areas for your organisation. An assessment of the current state of your lease environment, including types of leasing and the full inventory of your legal entities that are required to file financial statements, will help you model the impact in changing your financial statements and how that impacts your internal and external reporting. Tracking differences with IFRS16 ASC 842 and data integrity and quality, separating lease and non-lease components, is a big concern.

While the burden of the lease changes would seem only to hit the accounting departments, the new standard goes beyond a finance function exercise, and the implementation requires a holistic approach. There will be an impact across the organisation, and efforts should also heavily involve the operations, IT, treasury, tax, facilities and procurement groups. Today many companies do not have systems in place to effectively manage lease agreements under the new standard and are likely to need to review internal controls and related business process for capturing and accounting for lease agreements. Initial activities should concentrate on understanding the new standard and how it relates to the complexity of your company to determine the requirements and impact areas for your organisation. An assessment of the current state of your lease environment, including types of leasing and the full inventory of your legal entities that are required to file financial statements, will help you model the impact in changing your financial statements and how that impacts your internal and external reporting. Tracking differences with IFRS16 ASC 842 and data integrity and quality, separating lease and non-lease components, is a big concern.

How to navigate the potential challenges associated with the new lease standard IFRS16 ASC 842 implementation

The complexities of the implementation process depend on several factors, from the number of current leases that classify as operating or financing, the number of long-term contracts, service contracts with embedded leasing, to the diversity of the lease portfolio. As explained in a previous post, the main implementation challenges fall into three main areas.

Data collection: depending on the organisation, data might be decentralised in various formats and systems, resulting in a manually intensive gathering, analysing and consolidating work, which is time-consuming and prone to error. Before going out to collect your data, you need to know that not all solutions require the same dataset to do lease validation, cost centre allocation and information that you might not be thinking about. To avoid duplication and rework, streamline your data collection process, and understand the data requirements in the context of the solution you choose. Include in your project plan resources like data collection templates, and train people on how to make the first wave of data collection as easy as possible.

Business processes: business processes need to be designed to capture and integrate the relevant lease data and generate the related information for IFRS16 compliant financial reporting. Processes need to consider not only the existing agreements and their comparatives to achieve compliance, but also possible impacts on the company balance sheet.

IT systems: many software houses offer compliant solutions for lessees that are impacted by the new standard, unlike lessors who understand the complexities of lease accounting, but the acquisition of a leasing system can be daunting. If new software is needed, before jumping into the solution selection run an assessment where there is a holistic understanding of the IFRS16 requirements and from a lease transactions perspective, understand business flows of finance business processes related to maintaining lease agreements and IFRS16 lease accounting. Gather input from all functions not only from the accounting and finance team in the controlling area. After understanding the estate or leases landscape create project governance.

Having in mind those three areas, a pivotal point in your implementation journey is building your project management team. Set up a cross-functional team, where the project sponsor develops a clear communication plan that includes all stakeholders. As discussed before, this project goes beyond the finance function as an asset might be embedded and bundled in service contracts like in IT and data centres.  Educate and train the stakeholders to make sure they understand all types of leases and the impact on the new standard. With the new standard, finance and operating leases will require organisations to recognise a deferred tax asset and liability which may significantly impact the balance sheet. The lease accounting standards implementation requires significant resources equipped with appropriate skills and tools; and with the window of compliance getting smaller, great benefit can come from partnering with technology consultancy firms for the implementation and project management. They can manage the overall project, from the system assessment to the solutions selection, through to the coordination of the work of accounting firms and internal departments. They can also develop the group change management strategy including representatives from each department such as operations, facilities and the IT group. Working with lease accounting specialists that can help to interpret existing leases, they can understand the accounting implications of the new standards and guide you on the determination of the correct classification according to the standards. The consultants can support you with the preparation of the training material for your accounting teams in reporting on the new standards, providing in-depth insight to understand the key differences between ASC 842 and IFRS 16 to interpret data and report. Lease accounting specialists will also provide you with the insights on what tests will be performed for balance sheet audit.

Educate and train the stakeholders to make sure they understand all types of leases and the impact on the new standard. With the new standard, finance and operating leases will require organisations to recognise a deferred tax asset and liability which may significantly impact the balance sheet. The lease accounting standards implementation requires significant resources equipped with appropriate skills and tools; and with the window of compliance getting smaller, great benefit can come from partnering with technology consultancy firms for the implementation and project management. They can manage the overall project, from the system assessment to the solutions selection, through to the coordination of the work of accounting firms and internal departments. They can also develop the group change management strategy including representatives from each department such as operations, facilities and the IT group. Working with lease accounting specialists that can help to interpret existing leases, they can understand the accounting implications of the new standards and guide you on the determination of the correct classification according to the standards. The consultants can support you with the preparation of the training material for your accounting teams in reporting on the new standards, providing in-depth insight to understand the key differences between ASC 842 and IFRS 16 to interpret data and report. Lease accounting specialists will also provide you with the insights on what tests will be performed for balance sheet audit.

How can VIP Apps Consulting help?

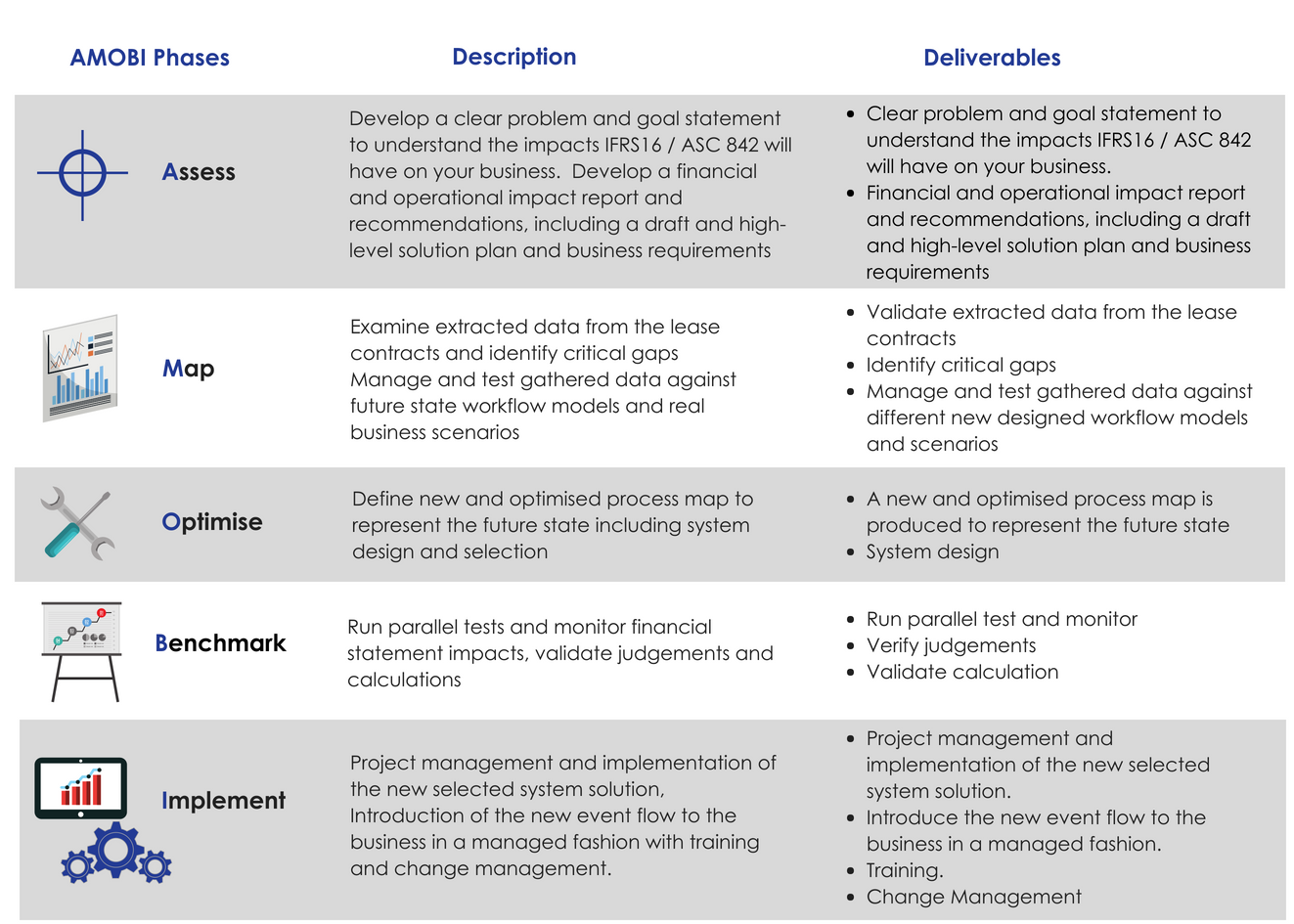

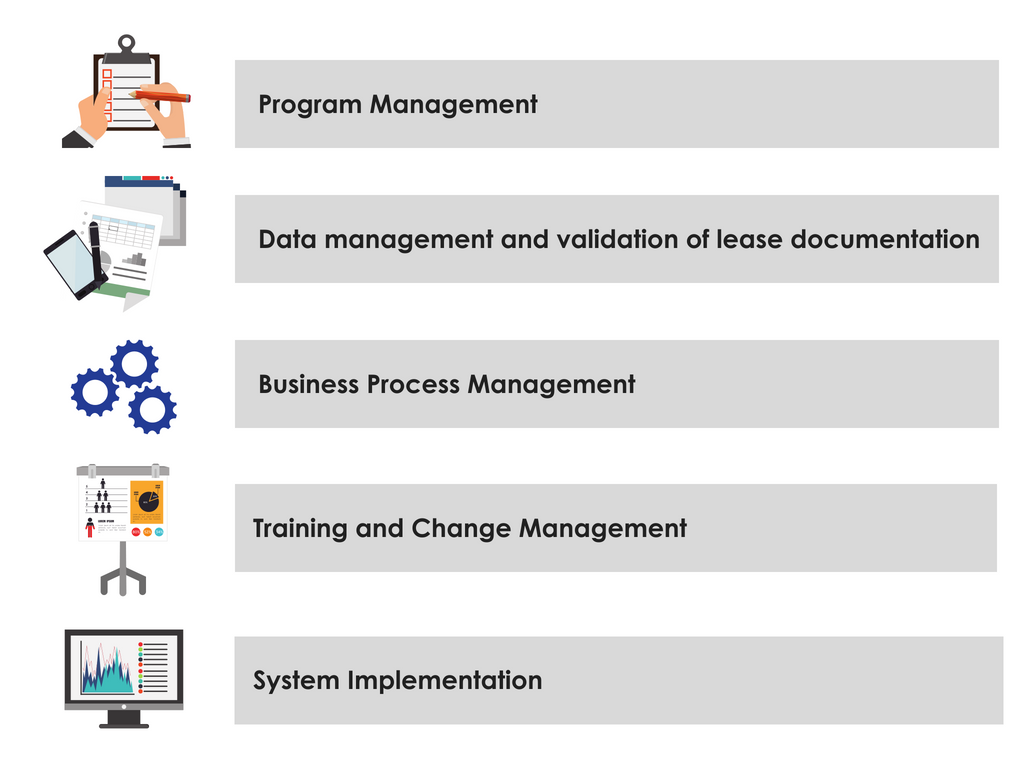

VIP Apps Consulting has an experienced international consultancy team that can support you throughout the IFRS16 and ASC 842 implementation journey. Our approach combines our leasing and technology expertise, and business process management capabilities to help our clients address issues from the accounting interpretation, business process design and optimisation to systems changes and new implementations. Equipped with our proprietary AMOBI methodology, the implementation of the new standard requires of a team with the tools and technology that can support you in the following work-streams:

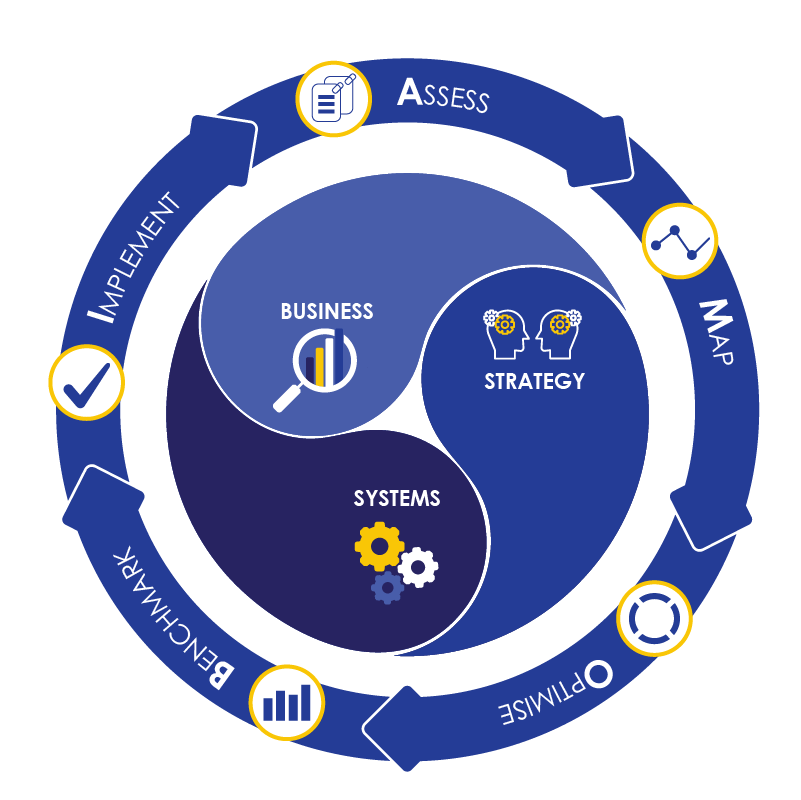

The AMOBI methodology provides the holistic approach required in a new standard implementation project.  The AMOBI way offers a collaborative approach between the business organisation, the systems that support it and the project team tasked with new standard implementation. The initial assessment phase will target the required new business process to ensure the business complies with the new leases standard. Using event-based flow mapping, and benchmarking any changes against real business transactions, we can help you identify the business process and technology to drive successful change.

The AMOBI way offers a collaborative approach between the business organisation, the systems that support it and the project team tasked with new standard implementation. The initial assessment phase will target the required new business process to ensure the business complies with the new leases standard. Using event-based flow mapping, and benchmarking any changes against real business transactions, we can help you identify the business process and technology to drive successful change.

A typical IFRS16 / ASC 842 implementation project using our AMOBI would include:

If you have not yet begun, now is the time to contact us and jump-start your IFRS 16 and ASC 842 implementation journey.