Automation and AI: The Path to Efficiency and Insights in Leasing and Asset Finance

Automation and artificial intelligence (AI) have created a transformative era in leasing and asset finance, where efficiency reigns supreme, and data-driven decisions have become the norm. The industry is witnessing a profound shift towards integrating AI to streamline operations and mitigate risks. By harnessing the power of AI algorithms, businesses gain access to invaluable insights that inform smarter risk assessments and investment strategies. However, achieving the delicate balance between automation and human intervention remains pivotal for sustainable success.

First featured in the 45th Edition of The World Leasing Yearbook 2024

From Excel to AI: Modernising Business Processes

In today’s landscape, many calculations and analyses are still performed using Excel spreadsheets scattered across different departments. This fragmented approach often results in bottlenecks, data silos, and labour-intensive processes, wasting the valuable time of skilled staff. To address these challenges, leaders must strive for productivity gains by introducing intelligent tools and automating business processes.

Robotic Process Automation (RPA) emerges as a potent solution to free up time and resources. PwC found that finance departments can reduce costs by double-digit percentages for many key functions through automation and process improvement. Deloitte has reached similar conclusions in a report showing that intelligent automation decreases business process costs by 25% to 40%. Some examples of use cases for AI and automation are:

Credit Risk Assessment: AI can analyse a vast amount of data, including credit history, financial statements, and market trends, enabling more accurate risk profiling and helping in making informed lending decisions.

Fraud Detection: AI algorithms can detect unusual patterns and anomalies in financial transactions, helping to identify and prevent fraudulent activities in real-time, speeding up invoice processing and reducing the risk of paying fraudulent invoices.

Predictive Maintenance: AI can predict when maintenance is needed for companies leasing out assets like machinery or vehicles. By analysing sensor data and historical performance, AI can proactively schedule maintenance, reducing downtime and enhancing asset longevity.

Customer Service Chatbots: AI-powered chatbots can handle routine customer queries, such as lease inquiries, payment status, or documentation requests, providing quick and efficient responses and freeing human agents for more complex issues.

Portfolio Management: AI can assist in optimising asset portfolios by analysing market conditions and performance data. This helps make data-driven decisions regarding when to buy, sell, or lease assets to maximise profitability.

Customer Onboarding Process: AI-driven document automation tools can streamline the creation and processing of leasing agreements, reducing paperwork, errors, and processing times. AI can review and extract key information from lease contracts, reducing the time and effort required for manual contract review. It ensures compliance with terms and conditions and helps in identifying potential risks.

How to Start Your Intelligent Automation Journey

At their core, bots are software programs capable of mimicking human-computer interactions. They are user-friendly and accessible, even for those with minimal coding knowledge. Today’s market boasts a range of user-friendly, low or no-code tools with which you can record and implement automated workflows. Additionally, you can work with solution providers, such as VIP Apps Consulting, who offer solutions tailored to specific use cases, easing the implementation process. You can begin your journey to intelligent automation with the following steps:

- Identify and analyse tasks with an employee-centric approach: engage with staff to understand their daily challenges, time-consuming tasks, and areas that can benefit from automation.

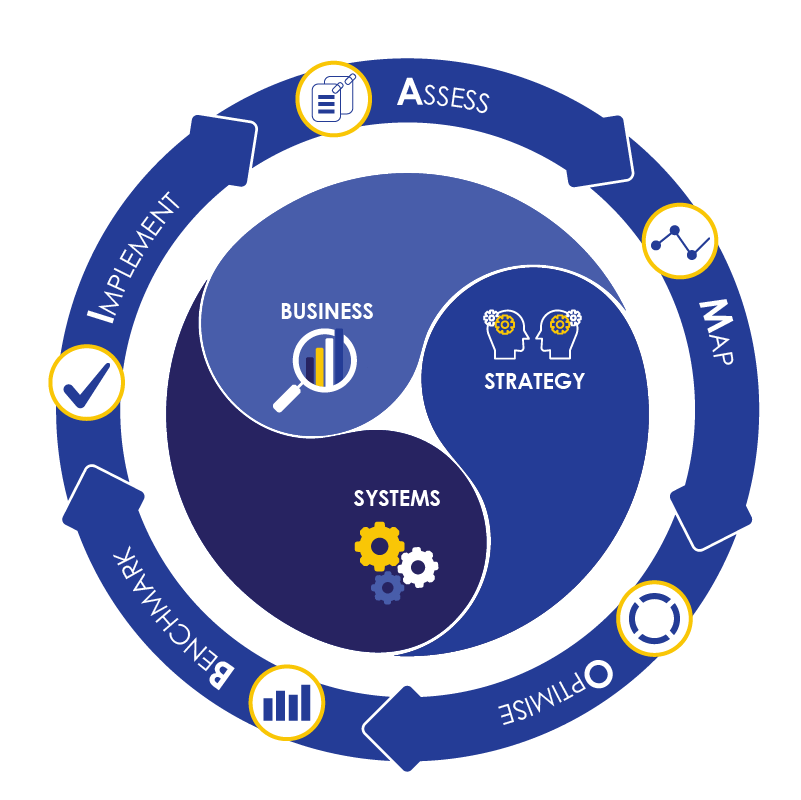

- Map business processes: Leverage methodologies, such as our proprietary AMOBI methodology, to thoroughly analyse existing business processes to identify optimisation, automation, or elimination opportunities. Utilise data-driven insights tools or process mining tools to prioritise areas for improvement.

- Identify automation opportunities and initiate a pilot: pinpointing areas ripe for automation and launching a pilot program for Robotic Process Automation (RPA). Initiating a pilot program with bots offers a multitude of advantages. Bots possess the ability to replicate most human-computer interactions, making them ideally suited for tackling straightforward, process-intensive tasks characterized by linear verification steps. This encompasses activities like invoice processing, account reconciliation, and onboarding procedures. The pilot phase serves as a valuable learning experience, furnishing you with profound insights necessary to progress towards the integration of Artificial Intelligence (AI). AI introduces a transformative dimension to automation by endowing automated processes with cognitive abilities. These AI-driven systems can think, exercise judgment, and continuously learn and adapt in response to changing circumstances. This opens the door to more predictive and prescriptive analytics. They excel at handling the heavy lifting in complex procedural tasks and excel at identifying and prioritizing findings that might otherwise escape notice due to time constraints or overwhelming data volumes.

Continuous Innovation with AMOBI Methodology

Driving continuous business innovation through process optimisation and automation as an enabler is crucial for strategic initiatives. In data-driven organisations, employees are liberated from time-consuming, process-heavy tasks, allowing them to focus on strategic activities and real-time decision support. Integrating an enterprise data platform and gathering live data from across the organisation facilitates this transformation. Self-service analytics, backed by advanced models, ensures financial data contributes to vital decisions.

Process optimisation and automation entail a shift from conventional processes to exploring better ways of achieving tasks. Business process optimisation can significantly impact the business by identifying areas for automation, data-driven opportunities, and cross-functional improvements. However, while automation and AI offer significant advantages, like enhancing efficiency and deriving valuable insights from complex data, they also introduce new risks to organisations. Organisations can turn to the AMOBI methodology to successfully navigate these innovations.

The AMOBI (Assess, Map, Optimise, Benchmark, Implement) methodology is an iterative framework rooted in the concept of continuous improvement. This proprietary methodology not only simplifies and automates processes but also systematically reduces risks. It provides a structured, templated approach for assessing initial requirements, root cause assessment, process mapping, optimisation, benchmarking, and successful implementation.

AMOBI’s holistic approach ensures that potential technology solutions are thoroughly evaluated before implementation. It forces organisations to consider the impact on processes, the overall organisation, and existing systems, preventing unforeseen complications down the road. In the case of looking at intelligent automation for repetitive tasks, the AMOBI methodology helps to avoid prematurely choosing technology solution(s) and then finding out another part of your business is impacted along the way because either the processes were not mapped beforehand or tested and acted upon.

Conclusion

In conclusion, the fusion of AI and intelligent automation is revolutionising leasing and asset finance by enhancing efficiency, reducing risks, and providing valuable insights. Organisations that embrace these technologies with a clear strategy and a systematic approach, such as the AMOBI methodology, can unlock their full potential.

By freeing time through automation, leasing and asset finance, professionals can focus on strategic initiatives, supporting the organisation’s growth and innovation. As technology continues to advance, the industry stands at the precipice of a transformative era where technology innovation and business process automation are essential enablers of success.

Source:

https://www.pwc.se/sv/pdf-reports/consulting/finance-benchmarking-report.pdf

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology-media-telecommunications/blue-prism-white-paper-final.pdf