IFRS 16 ASC 842 Oracle Property Manager & Equipment Lease Functionality

Upcoming changes in accounting regulation, the IASB’s IFRS 16 and the FASB’s ASC 842 lease standards will require companies to account for equipment leases and real estate property as assets and liabilities on their balance sheet. Both new lease accounting standards require the generation of new lease accounting transactions requiring adjustments to business operations, people, systems and processes.

At a high level, the IFRS 16 standard requires most leases from a lessee perspective to be categorised as finance leases, while ASC 842 standard classifies as two types of leases finance and operating. CFOs and finance executives need a solution that will allow them to streamline the processes within their business and to transform their lease management capabilities in compliance with both new standards. A solution that ensures the accuracy of the balance sheet to reflect both asset and liabilities to include right-of-use (ROU) assets and lease liability tracking. The requirement for appropriate system functionality to produce accounting entries, periodical calculation of depreciation and interest expense for finance lease assets, calculate periodic lease expense for operating lease assets, generate and validate invoices against contract terms, enables audit of financial assumptions, approvals and data changes.

As companies hold lease information in disparate systems, in the transition to compliance, your project needs to facilitate the data collation, extraction and analysis to map and capture the right of use asset details, improvement in controls and reduction manual efforts. Selecting a solution will require your organisation to run solution assessments based on the requirements for accounting and lease management capabilities, the ability of the solution to integrate with existing ERP platforms and considering the impact on the different process areas.

Lease Accounting Standards Compliance Solution

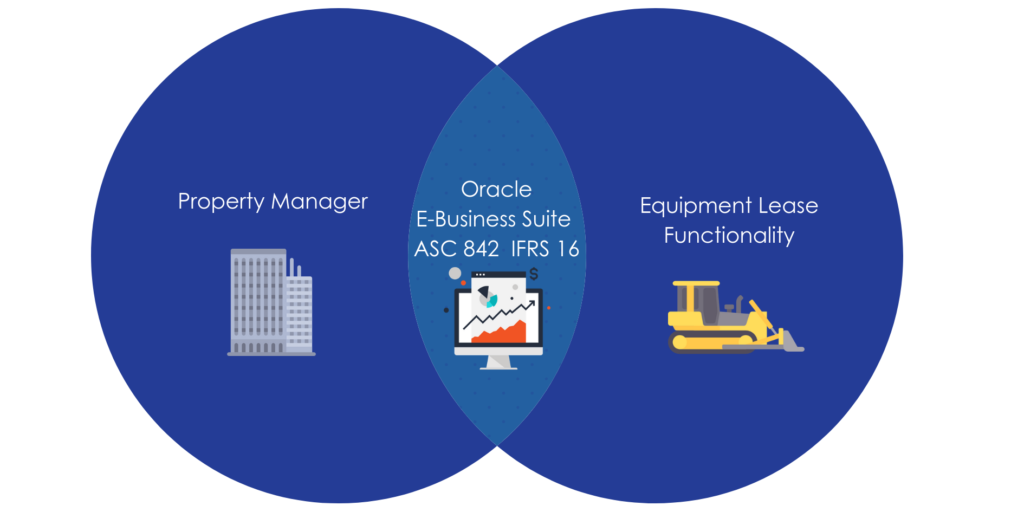

Leveraging on your existing investment, Oracle E-Business Suite Property Manager & Equipment Lease Functionality offers a solution that complements your technology strategy, an advanced lease compliance implementation that guides the organisation with integrated workflows, providing end-to-end processing beyond calculations helping finance executives deliver the balance sheet and reporting requirements that best reflects their obligations in compliance with the new standards.

The Oracle E-Business Suite solutions support the organisation compliance efforts facilitating a smooth transition to the new lease accounting standards IFRS16 and ASC842. The compliance patch update combines functionality enhancements with statutory and regulatory updates in a consolidated patch set to support the new accounting standards, with new and changed features that cover the following functional and technical capabilities:

How can VIP Apps Consulting help?

With the right solutions in place, the new standard gives organisation a great opportunity to improve operational and financial performance. VIP Apps Consulting offers a holistic FASB ASC 842 and IASB IFRS 16 lease accounting standards compliance solution that streamline and automate lease accounting for Oracle users. Our lease accounting and technology experts support finance teams with the optimisation of business processes, data collections, technology consulting and reporting implementation in all your leases areas.