Why Automated Document AI Solutions Need Humans

The rise of AI has ignited a revolution in document processing across all industries. Within Asset Finance, automation powered by Document AI promises significant benefits: streamlined workflows, reduced processing times, and cost savings. Whilst AI undeniably possesses impressive capabilities, a critical misconception sometimes shows up in boardrooms; the one of fully autonomous document processing. Here’s where the narrative needs a shift. In Asset Finance, where precision and accuracy are paramount, the future of document processing lies in a collaborative dance between AI and human expertise.

Power of Automation

Document AI helps at automating repetitive tasks like document classification, data extraction, and data entry. This frees up valuable human resources from tedious manual processing, allowing them to focus on higher-value activities. However, it’s crucial to acknowledge the limitations of current AI technology. No document AI automation system, regardless of its sophistication, is 100% perfect. Factors like document quality, formatting inconsistencies, and complex language can lead to errors in data extraction.

Consider the emerging field of generative AI, where algorithms can create realistic but fabricated text. These “hallucinations” highlight the potential for AI to generate seemingly plausible, yet entirely fictional data. Imagine an invoice where the AI misreads a handwritten number, leading to an inaccurate loan amount being processed. While such instances may seem rare, they underscore the importance of human oversight in the document processing loop.

Human Advantage

Enter the concept of “human-in-the-loop” (HITL) document processing. This approach uses the strengths of both AI and human intelligence, creating a robust and reliable system. The AI handles the heavy lifting of initial classification and data extraction, while humans provide the critical oversight and verification needed to ensure accuracy.

The strength of humans for AI:

- Handling Exceptions: AI is brilliant with standard formats. However, real world documents often deviate from the norm. Humans can effectively handle exceptions, like handwritten notes, blurry scans, or unexpected layouts, ensuring data is extracted correctly.

- Identifying Ambiguity: Language can be nuanced and ambiguous. AI may struggle with context dependent information or unclear phrases. Human judgment and reasoning are invaluable in interpreting such ambiguities to extract accurate data.

- Enforcing Business Rules: Certain industry regulations or internal business rules may require specific information to be extracted. Humans can ensure the AI model adheres to these rules during document processing, maintaining compliance and data integrity.

The Balance of Automation

While automation offers undeniable benefits, a crucial question arises: at what point does replacing human labour with AI become counterproductive?

Here are some key considerations:

- Errors – Consider the potential financial and reputational damage caused by inaccurate document processing. In Asset Finance, a single data extraction error could lead to incorrect loan approvals, missed payments, or regulatory issues. The cost of human oversight is relatively smaller in comparison to the cost of a critical error.

- Expertise – Human expertise in Asset Finance is invaluable. Experienced professionals can identify potential red flags in documents, assess loan risk, and ensure compliance with regulations. Automating all tasks in such a nuanced environment could lead to overlooking crucial details.

- Work – AI is not about replacing human workers, but rather augmenting their capabilities. By automating repetitive tasks, AI frees up human talent to focus on higher value activities, fostering a more efficient and productive work environment.

The Future for Asset Finance

The future of document processing is not a competition between human and machine, but rather a balanced, collaborative effort. AI handles the heavy lifting of automation, while human expertise provides the essential oversight and critical thinking skills needed for accuracy and compliance. This “human-in-the-loop” approach unlocks the full potential of document AI:

- Enhanced Accuracy – The combination of AI’s efficiency and human verification minimises errors, leading to a more reliable and trustworthy document processing system.

- Streamlined Workflows: Automation frees up valuable human resources, allowing them to focus on higher value tasks like risk assessment and customer service.

- Improved Decision-Making: With accurate and timely data at their disposal, human decision makers can make informed asset financing decisions with greater confidence.

- Reduced Operational Costs: Combined with a reduction in errors, the efficiency of AI automation leads to cost savings on labour and resources.

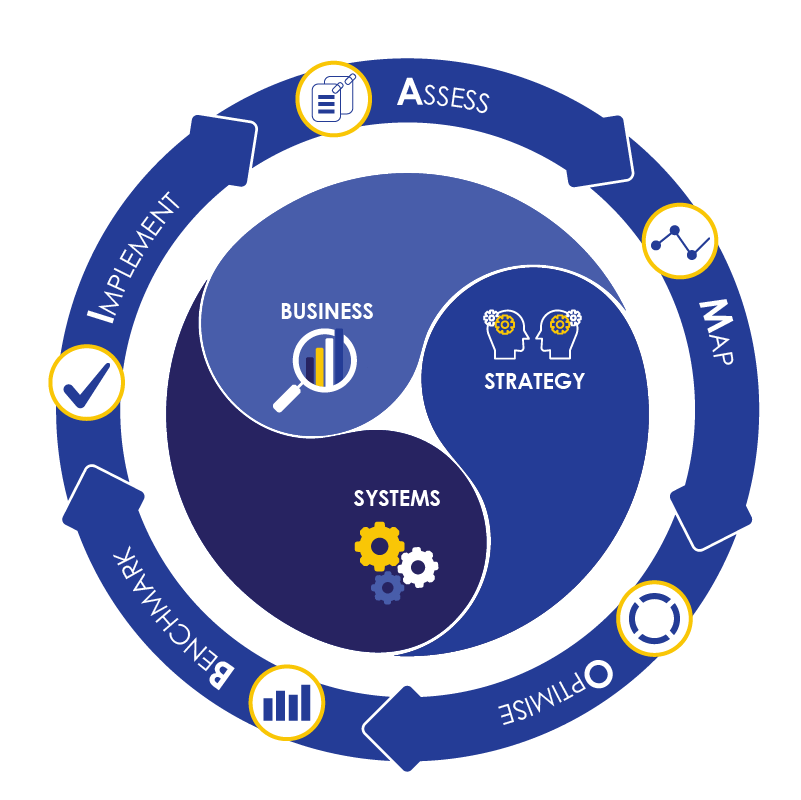

AMOBI Methodology

Trust and reliance of automated processing is dependant on the quality of data and the accuracy of models. A core principle of VIP Apps Consulting’s Document AI services is to ensure the design of our solutions, by default, includes Human verification, oversight and intervention for critical decisions, fostering trust and maximising the benefits of AI.

The AMOBI methodology, developed by VIP Apps Consulting, provides a structured and efficient framework for implementing Document AI in Asset Finance businesses.

- Assess

- Map

- Optimise

- Benchmark

- Implement

Each stage plays a crucial role in ensuring a smooth and successful Document AI implementation.

Ready to harness the full potential of Document AI? Reach out directly to Nilesh Chadva and take the first step towards AI document processing solutions. Email now: nilesh.chavda@vipappsconsulting.com