Oracle Financial Services Lending and Leasing (OFSLL)

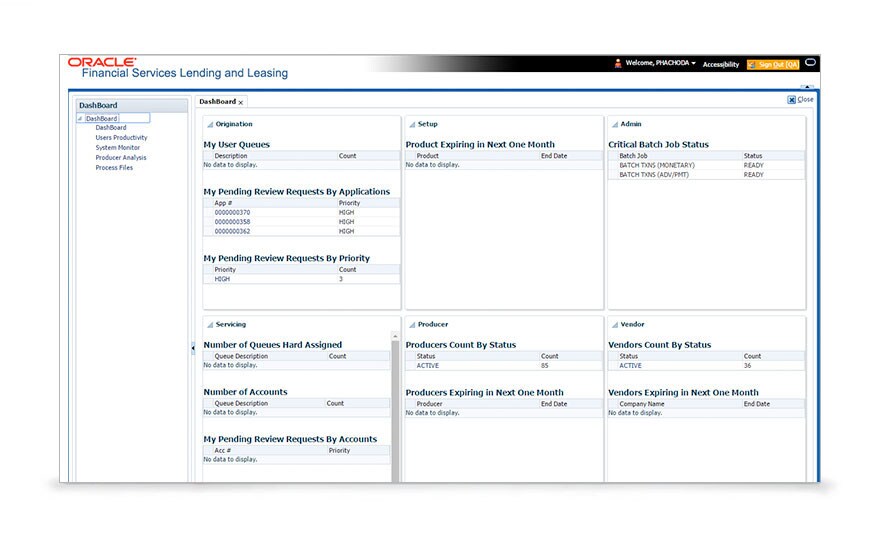

Oracle Financial Services Lending and Leasing (OFSLL) is a comprehensive lending and leasing solution for loan, lease and line of credit products on a single platform.

It provides end-to-end capabilities that support direct and indirect consumer lending addressing the key pillars of the lending business:

- Origination

- Servicing

- Collections

Oracle Financial Services Lending and Leasing (OFSLL) is a single integrated platform that enables financial institutions provide better services and reduce delinquency rates, with solutions for the auto finance, wholesale floor planning, home loans, mortgages, personal loan, secure and unsecured lending, line of credit and consumer lease.

The solution offers unique functional coverage and the ability to leverage enterprise data to make better product offers and financing decisions. Design to help organisations make faster decisions and respond quickly to changing market dynamics OFSLL offers a comprehensive set of configurable parameters which enables to set rules based on your specific business requirements and a built-in workflow module to configure workflows based on product lifecycles.

The solution provides real-time information and unparalleled insight into every detail of a consumer and dealer financial information enabling organisations to increase profitability, improve customer service and maximise productivity.

It supports your requirements as your business evolves, with a state of the art and service orientated architecture, the unique value of Oracle Financial Services Lending and Leasing:

- reduces operating costs

- delivers enhanced user experience and seamless workflow across departments

- improves customer service and

- improves the efficiency of your lending and leasing operations.

OFSLL provides flexible options for deployment on-premise and on the cloud, allowing lenders to scale their business operations rapidly as their business grows. Visit our Oracle consulting services page to learn more.